India has proved to be the most stable country in the sub-continent region which is why it has been able to see a substantial shift not just from China, but also from neighbouring countries such as Bangladesh, Pakistan, Sri Lanka and Indonesia.

Unlike predictions, 2022 has been a roller-coaster ride for the apparel industry, all thanks to – Russia-Ukraine war, recession in Americas and Europe and rising fuel costs. The apparel manufacturing destinations such as Bangladesh, Myanmar, Pakistan, Sri Lanka, till 2021, were busy grabbing the shift that was coming from China but the situation has become so complicated that now these destinations are fighting with each other to sustain buyers. However, it is seemingly a difficult task for these countries as most of them are severely facing the worst economic challenges in their history!

Amidst all this, India has proved to be the most stable country in the sub-continent region which is why it has been able to see a substantial shift not just from China, but also from neighbouring countries such as Bangladesh, Pakistan, Sri Lanka and Indonesia. The OTEXA data from January to July ’22 also endorses this fact as it states that India’s growth rate (59.40 per cent) in the US apparel market is the second highest among the top 40 apparel shippers!

Buyers’ trust in India is increasing post-pandemic as India trumped Indonesia in 2021 to become the 4th top apparel shipper to USA

India has subtly been taking away business from Indonesia in the difficult and competitive US market. India and Indonesia are two major Asian apparel manufacturing hubs and hold great position in the US market.

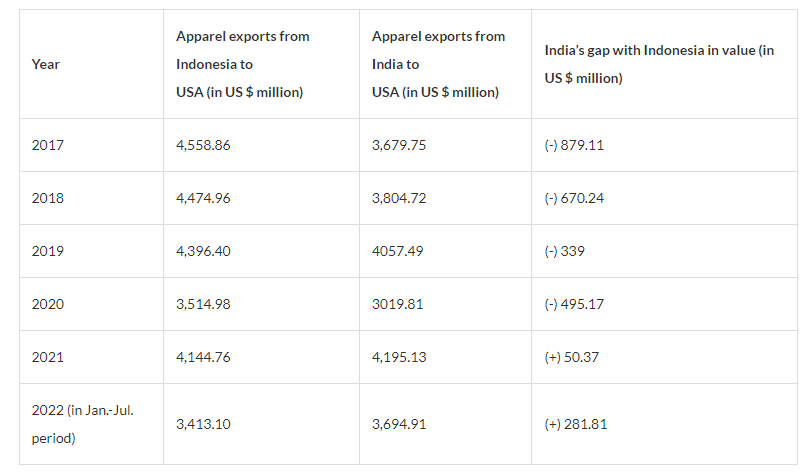

Indonesia had been holding the fourth spot since long amidst top apparel exporters’ tally to US, while India remained on the fifth position all through the time. However, the situation has taken a turn in India’s favour and the country surpassed Indonesia in CY ’21 for the first time ever to become the 4th largest apparel exporter to USA.

According to the official US apparel import data, India clocked US $ 4.19 from its apparel exports to USA in 2021, outclassing the performance of Indonesia that shipped US $ 4.14 billion worth of apparels to USA.

India’s supremacy has continued even in 2022 as, during Jan.-Jul. ’22 period, India clocked US $ 3.69 billion from its apparel shipment to USA, which is much better than what Indonesia earned – US $ 3.41 billion.

It’s worth noting here that in 2019, India’s exports of apparel valued US $ 4.05 billion and its gap from Indonesia’s shipment was US $ 339 million. The gap further increased to US $ 495.17 million in 2020, in pandemic-induced year. However, all through 2021, India’s apparel export fraternity – buoyed by strong orders and revival of global retail industry – remained resilient and outperformed its own exports to USA.

Table 1: Exports to USA from India and Indonesia

Amidst worst-ever economic crisis in Sri Lanka, orders are moving to India

According to Ministry of Textiles’ Secretary, Upendra Prasad Singh, some countries which were earlier importing from Sri Lanka, have started contacting India, as Sri Lanka is facing its worst economic crisis.

“Some orders have already been given to companies in the Tirupur district of Tamil Nadu,” he stated in a conversation with ANI recently.

To support the industry in its endeavour to cater to these orders coming from Sri Lanka and be competitive with other Asian countries like Indonesia, Pakistan, India has eliminated 11 per cent import duty from cotton. “Since now we do not have to pay import duty on cotton, this will certainly make our exporters more competitive,” commented UP Singh.

The claims made by Textile Secretary were cross-checked by the data analysis team of Apparel Resources Team by analysing exports of cotton-made apparel by both India and Sri Lanka.

Indian denim apparel exports largely remained stagnant for years; however 2022 brings substantial change in its exports to USA. Sri Lanka has always remained ahead of India in its denim apparel exports which is a product category made up of cotton. (See Table 2)

Table 2: Denim apparel shipment to USA: Comparison between India and Sri Lanka

However, in Jan.-Jul. ’22 period, India clocked US $ 43.56 million in its denim apparel shipment to USA, noting a whopping growth of 102.31 per cent, beating Sri Lanka by a comfortable margin of US $ 5.53 million.

The order shift from Sri Lanka is for real as understood by Team Apparel Resources while talking to Nimish Dave, Founder, The Idea Smith who said Primark recently got in touch with its India’s vendors to shift orders of both knitwear and woven garments from Sri Lanka in accordance with their de-risking strategy.

“In all probability, Primark has recently shifted orders to India worth US $ 25-30 million amidst economic crisis that Sri Lanka has been facing and the situation may remain the same for another 6 months! Since we are already working with some Primark-approved factories in India, we have accommodated some of these orders,” asserted Nimish.

Diversion of orders from Pakistan and Bangladesh

Textile and garment exports from Pakistan amounted to US $ 21 billion in FY ’22, but now, due to the devastation caused by flooding, the country’s garment industry fears a probable cancellation of many export orders by international brands. This may result in a declining export of around 30 per cent this fiscal year.

Similarly, economic challenges with Bangladesh are not letting factories operate with their full strength and buyers are shying away – temporarily if not permanently – from the country. India being stable on all fronts is able to see some diversion of orders from these two countries of late.

According to P Sundararajan, Chairman & Managing Director, SP Apparels Ltd., there are diversions of some orders from Bangladesh to India due to certain prevailing issues there.

“Last year, the customers were talking about diverting their business from China. Suddenly this time, they want to divert some of the business from Bangladesh for two reasons – one is the sharp increase in orders to Bangladesh, which is too risky for them. Secondly, the raw material costs, the power problems and uncertainties in deliveries,” mentioned Sundararajan, adding, “These are big concerns for the buyers. So, they want to play with the safer country and they prefer India. We are even getting some regular orders that are supposed to be produced in Bangladesh.”

Amrutesh Jaghuva, Executive Director, Quality Knitwears Pvt. Ltd., Madurai, who works with Italian and Spanish buyers told Team AR that he is seeing some increased orders for Winter ’23 season (majorly outerwear) which buyers used to source majorly from Bangladesh before. “Though we didn’t see any benefits in Summer ’23 order placement from European buyers due to prevalent challenges in the European regions, the good thing is Winter ’23 is going to be fruitful for us. Buyers today do not want to take risk and place orders in countries (Pakistan and Bangladesh) that are already pressed economically,” mentioned Amrutesh.

However, Amrutesh believes the situation in Europe is still not certain due to the after-effects of Russia-Ukraine war and exports to Ukraine has almost come down to standstill, while recession in Spain, Germany and France is also making it difficult for apparel buyers to re-think their strategies. “We anyway have to wait for another 5-6 months to predict if this order shifting trend continues in long run!” averred Amrutesh.

The reduced yarn prices in India are also supporting factories to work on orders competitively. “Recently yarn prices in India have decreased by 10-15 per cent and this is going to benefit mainly India, not much the competitor countries! I feel that casualwear and babieswear product categories will witness more demand compared to fashion garments. Currency depreciation is also in our favour, so we are hopeful that now some orders from neighbouring countries will be there,” commented K N Subramanian, President, Tirupur Exporters’ Association (TEA).

Raghavendra Shah, Sr. VP (Production), Texport Industries opined that, more than Pakistan, the factories in India are seeing some movement in their orders that are skewing from Bangladesh.

“India is trying to pull back the business which is already there in the market. Bangladesh is nearing to lose its LDC status in next 3 years, so buyers are already developing alternate source base and India poses great long-term opportunities for buyers. Recent schemes launched by the Indian Government that include PLI and PLI 2.0 (which is specific to textile only) are aggressively trying to put India as a preferred destination for buyers in time to come,” told Raghavendra to Team AR, concluding on a positive note, “We have sensed this shift, hence Texport is investing in a new unit that will accommodate around 3,000 sewing machines and expand our capacities.”

Source: AR